Prioritizing Lowest Cost Over Total Value

If you’re sourcing EV battery packs only by lowest cost per kWh, you’re setting your program up for hidden costs later. As an EV battery pack manufacturer and EV battery pack supplier, I see this mistake all the time in U.S. automotive battery pack procurement.

Why “cheapest pack” is a trap

When an OEM selects an EV battery pack OEM purely on unit price, they usually overlook critical value drivers:

- Warranty terms – Short or weak warranties shift risk back to you.

- Degradation behavior – Faster capacity fade means more complaints, more replacements, and weaker resale value.

- Cycle and calendar life – A pack that looks cheap on paper can cost more over the vehicle’s life.

- Field failure rates – Low-cost packs with poor process control lead to higher defect rates and service costs.

The result?

- Higher failure rates in real-world use

- Increased warranty claims and service logistics

- Unexpected replacement expenses that kill your original business case

A 5–10% “saving” on EV battery pack cost per kWh can easily be wiped out by one round of large-scale replacements.

Best practice: Total cost of ownership first

For the U.S. market, I always advise OEMs and fleet operators to treat EV battery pack sourcing as a TCO (Total Cost of Ownership) decision, not a spot price negotiation.

At minimum, compare EV battery pack manufacturers using:

- TCO models over the vehicle life (8–15 years)

- Degradation and range retention curves under U.S. duty cycles

- Expected warranty costs per vehicle

- Downtime impact for fleets and commercial users

When you evaluate an EV battery pack supplier on total value, not just upfront price, you get:

- More predictable lifecycle cost

- Stronger customer satisfaction and brand protection

- A battery platform that scales profitably, not just cheaply

In short, the right custom EV battery pack is the one with the lowest TCO, not the lowest quote.

Overlooking Supplier Technical Capabilities and Scalability

When OEMs source EV battery packs in the U.S., picking the wrong EV battery pack supplier is one of the fastest ways to blow up timelines and budgets.

Why Supplier Technical Depth Matters

If your EV battery pack manufacturer can’t handle modern architectures like cell-to-pack (CTP), CTP 3.0, or cell-to-chassis (CTC), you’re taking a real risk:

- Incompatibility with your vehicle architecture

- Delays in customization (thermal, mechanical, BMS integration)

- Bottlenecks in scaling production once you move from prototype to volume

You want a partner that already understands custom EV battery pack design, not one learning at your expense.

What I Check Before Shortlisting a Supplier

I treat EV battery pack sourcing like a long-term platform decision, not a one-off buy. At minimum, I verify:

| Area | What to Look For |

|---|---|

| Technical know-how | Proven CTP/CTC designs, thermal management, BMS integration |

| R&D investment | Active development in higher energy density, faster charging, safety |

| Scalable production | Multi-line capacity, automation, U.S.-friendly logistics |

| Similar OEM experience | Case studies with comparable vehicle classes and volumes |

| Engineering support | Early-stage co-design, simulation, and validation support |

For example, when I compare options, I look for partners already shipping module-to-pack integrated EV battery systems and modular vs integrated pack platforms, similar to what’s outlined in this EV battery pack guide for OEMs.

Best Practices for OEM Battery Supplier Selection

To avoid common EV battery sourcing challenges:

- Audit technical capabilities: Ask for real project examples, test reports, and pack tear-downs.

- Validate scalability: Request a clear ramp plan from pilot to mass production, including realistic EV battery pack lead time.

- Benchmark against top players: Compare any potential partner against leading global EV battery pack suppliers on tech, cost per kWh, and delivery reliability.

If the supplier can’t show you that they’ve done what you need, at the scale you need, for OEMs like you—they’re not the right EV battery pack OEM partner.

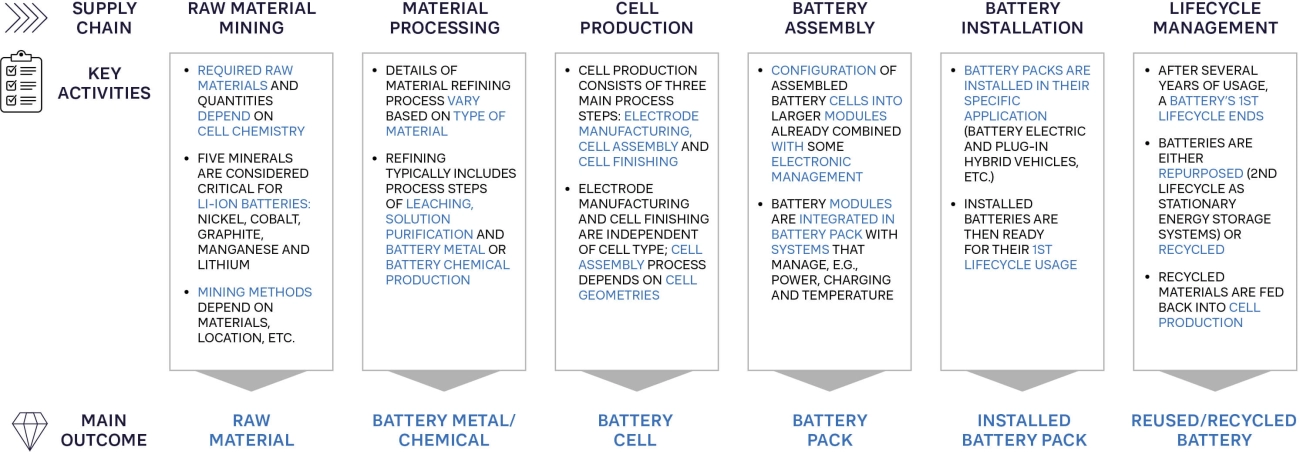

Ignoring Supply Chain Resilience and Geopolitical Risks

When OEMs source EV battery packs, one of the biggest mistakes I see is ignoring supply chain resilience and geopolitical risk. If you depend on a single EV battery pack supplier or one country for cells, packs, or critical minerals, you’re asking for trouble.

Here’s what usually goes wrong when supply chains are too fragile:

- Raw material shocks – Lithium, nickel, and cobalt price swings or shortages suddenly blow up your EV battery pack cost per kWh.

- Trade and tariff issues – New regulations, export controls, or tariffs can stall imports from overseas EV battery pack manufacturers overnight.

- Disruption events – Pandemics, port congestion, or regional conflicts can stop pack shipments and delay vehicle launches by months.

For OEMs in the United States, this can easily turn into missed SOP dates, line downtime, and lost market share if you can’t deliver vehicles on time.

To reduce EV battery sourcing challenges, I always push for:

- Multi-source strategies

- Qualify at least two EV battery pack manufacturers for each key platform.

- Split volume across regions (U.S., Europe, Asia) to avoid overreliance on one geography.

- Regional and nearshore production

- Prioritize North American or European pack assembly where possible to cut lead time risk and logistics complexity. For example, many OEMs now benchmark regional options using lists like the top EV battery pack manufacturers in the US and leading EV battery pack manufacturers in Germany.

- Transparent, resilient supply chains

- Ask every EV battery pack OEM for clear visibility on cell suppliers, raw material sources, and contingency plans.

- Build in safety stock and flexible logistics routes for critical programs.

A smart OEM treats EV battery pack sourcing like a strategic risk function, not just a purchasing decision. If your EV battery pack lead time, cell sourcing, and logistics are all tied to one country or one factory, your entire program is exposed.

Underestimating EV Battery Quality Assurance

When OEMs source from an EV battery pack supplier or EV battery pack manufacturer, cutting corners on testing and certifications is one of the most expensive mistakes they can make.

Why QA and Certifications Matter

Too many EV battery pack OEMs focus on price per kWh and skip:

- Full abuse and safety testing

- Thermal management validation

- Long-duration cycle and calendar life testing

That’s how you end up with:

- Non-compliance with UN 38.3, ISO 26262, UL 2580 and other standards

- Recalls and field failures that wipe out any cost savings

- Thermal events or safety incidents that damage your brand and trigger investigations

In our own automotive battery pack production, we treat standards as the floor, not the ceiling. Third-party testing and robust EV battery quality assurance are baked into our process, not sold as an add-on.

What OEMs Should Demand

If you’re serious about EV battery pack sourcing in the U.S. market, build these into your procurement checklist:

- Certified compliance with UN 38.3, ISO 26262, and UL 2580 at pack level

- Independent lab validation of safety, thermal performance, and durability

- On-site audits of the EV battery pack factory, including process controls and traceability

- Clear documentation of DFMEA/PFMEA, PPAP, and validation reports

If you’re not seeing this level of discipline, you’re taking on more risk than you think. For a deeper dive into what robust certification really looks like, I recommend reviewing how UL 2580 and ISO 26262 certifications apply to EV battery packs and aligning your supplier requirements accordingly.

Neglecting Sustainability and Ethical Sourcing in EV Battery Pack Sourcing

When OEMs source EV battery packs, ignoring sustainability and ethical sourcing is a fast way to damage the brand in the U.S. market. It’s not just about meeting regulations—it’s about trust.

Common mistakes OEMs make:

- No verification of responsible minerals

Skipping checks on where lithium, cobalt, nickel, and graphite come from is risky. Without verified, conflict-free, and child-labor–free sources, an EV battery pack supplier can put your entire EV program under a spotlight. - Overlooking low‑carbon manufacturing

Many OEMs still focus on EV battery pack cost per kWh and forget the carbon footprint of the automotive battery pack factory. That’s a problem when U.S. policies and buyers are watching total lifecycle emissions, not just tailpipe emissions.

Real risks for OEM battery sourcing in the U.S.:

- Reputational damage if media or NGOs link your vehicles to unethical mines or high‑carbon EV battery pack production.

- Regulatory penalties and lost incentives if you’re not aligned with IRA and FEOC rules for EV battery sourcing challenges.

- Loss of consumer trust among U.S. buyers who increasingly expect transparent and sustainable EV battery pack OEM partners.

Best practices when choosing an EV battery pack manufacturer or wholesale partner:

- Require full traceability reports

Ask for end‑to‑end traceability on key materials, including mine of origin, refiner, and cathode/anode plants. This should be standard from any serious custom EV battery pack supplier. - Insist on ESG‑aligned suppliers

Work only with EV battery pack manufacturers that publish ESG reports, have third‑party audits, and can show low‑carbon production methods, from cell manufacturing to battery thermal management and cooling strategies.

In the U.S. market, sustainable EV battery sourcing is now a core part of total cost of ownership, not a “nice-to-have.” OEMs that lock in clean, traceable, and ethical EV battery pack sourcing will be the ones that stay ahead of regulations—and customers.

Poor EV Battery Contract Negotiation on Lead Times and Flexibility

When OEMs source from an EV battery pack supplier or EV battery pack manufacturer, the contract terms around lead time and flexibility can make or break a program. A lot of teams lock into rigid terms just to secure capacity, but don’t negotiate buffers for ramp-up, design tweaks, or volume swings.

That’s a problem in EV battery pack sourcing, because:

- Lead times are long: 12–18 months is common for automotive battery pack production.

- Designs evolve: Cooling layouts, pack height, or BMS specs often change late in the game.

- Demand is volatile: Launch curves rarely match the original forecast.

If you accept fixed volumes and fixed schedules with no flexibility, you’re signing up for:

- Program delays when the EV battery pack lead time can’t absorb design changes

- Expensive change orders or retooling fees for minor pack or BMS adjustments

- Stranded capital if volumes drop but your minimum take-or-pay is locked in

When I negotiate with an EV battery pack OEM or automotive battery pack factory, I push for contracts that protect the program, not just the price per kWh:

- Volume flexibility clauses

- Allow +/- volume bands per quarter (for example, ±20–30%)

- Define how far in advance final volume commitments are locked

- Milestone-based payments

- Tie payments to clear deliverables: design freeze, validation, SOP, ramp targets

- Limit upfront exposure if the EV platform or pack architecture shifts

- Lead time buffers and change windows

- Built-in windows for design changes before tooling and before SOP

- Explicit timelines for engineering change implementation and cost impacts

Done right, your EV battery pack cost per kWh stays competitive, while your contract still supports real-world launch conditions. That’s how you avoid 6–12 month slips due to overly rigid EV battery sourcing terms—and keep your supply chain aligned with U.S. market demand.

Overlooking Integration and Customization Needs

When OEMs treat EV battery pack sourcing like buying a standard component, they usually pay for it later. Grabbing an off‑the‑shelf pack from an EV battery pack supplier that doesn’t match your voltage, cooling, or BMS strategy is one of the fastest ways to kill performance, range, and safety.

A generic pack may look cheaper and faster on paper, but real-world issues pile up:

- Voltage and architecture mismatch – Poor fit with your powertrain, DC fast charging, or inverter design.

- Cooling system conflicts – Liquid vs. air cooling, wrong manifold layout, or weak thermal performance that forces derating.

- BMS integration headaches – CAN protocols, safety logic, diagnostics, and OTA update support not lining up with your vehicle platform.

If you’re building for the U.S. market, with tight timelines and strict safety expectations, you can’t afford these integration gaps.

Why custom EV battery packs matter

You want a custom EV battery pack designed around:

- Your target voltage and power profile

- Your thermal strategy (liquid, refrigerant, or advanced cooling plates)

- Your BMS, telematics, and cybersecurity requirements

- Your packaging envelope and crash structures

That’s why I always push OEMs to work with an EV battery pack manufacturer that can co-develop from day one—not just ship boxes. The right automotive battery pack factory will bring engineering support, DFMEA input, and packaging options early in the design cycle so you don’t end up redesigning the vehicle around the pack at the last minute.

If you’re still mapping the market, it helps to look at how leading players position themselves and what they offer in terms of integration support; this is covered well in resources like a global EV battery pack market outlook through 2030.

Best practices for OEM battery supplier selection

When you evaluate an EV battery pack OEM or wholesale partner, bake integration into your sourcing checklist:

- Demand early joint engineering: CAD sharing, interface specs, packaging reviews, cooling layouts.

- Lock in BMS compatibility: Protocols, diagnostics, safety functions, cybersecurity, OTA update path.

- Validate with vehicle-level tests: Not just cell or module tests—full-pack behavior in your platform.

- Plan for future variants: Same pack family supporting multiple trims, chemistries, or CTP/CTC evolutions.

Bottom line: If your EV battery pack sourcing doesn’t prioritize integration and customization, you’ll spend the money anyway—just later, in rework, delays, and performance compromises.

Insufficient Focus on Long-Term Partnership and Support

When OEMs treat EV battery pack sourcing as a one-off purchase instead of a long-term partnership, they leave a lot of value on the table. A solid EV battery pack supplier shouldn’t just ship packs and disappear. You need an EV battery pack manufacturer that will stay engaged through software updates, diagnostics, and end-of-life planning.

If your EV battery pack OEM can’t support over-the-air BMS updates, remote diagnostics, or performance optimization, you’re looking at higher service costs, more downtime, and frustrated drivers. And with second-life and recycling now tied to regulations and brand image in the U.S., ignoring long-term support can become a real liability.

When I structure EV battery pack sourcing deals, I focus on:

- After-sales service commitments

- Response times, field support, spare parts, and failure analysis.

- Clear technical roadmap

- How their pack architecture, BMS, and formats will evolve over 5–10 years.

- Lifecycle and second-life planning

- Take-back options, reuse in ESS, and recycling programs that align with U.S. regulations.

- Data and diagnostics access

- OEM-level access to pack data, APIs, and tools for in-house service teams.

The right automotive battery pack factory should feel like a long-term engineering partner, not just a wholesaler. If you’re exploring advanced pack concepts like CTP and CTC that require tighter collaboration over time, it’s worth looking at how CTP and CTC technologies can elevate EV battery performance as part of your long-term strategy.