EV Battery Pack

If you’re trying to figure out how OEMs evaluate EV battery pack suppliers, you’re not looking for theory — you’re trying to decide who gets the program.

And you already know the stakes.

Today, the battery pack can represent 35–50% of total EV cost. One misjudged supplier on cost per kWh, production capacity, or safety performance can blow your SOP date, your margin, and your brand reputation in a single model cycle.

In this guide, you’ll see the exact key criteria that matter when top automotive OEMs evaluate EV battery pack suppliers in 2025–2026:

- How sourcing teams really compare delivered $/kWh vs. total cost of ownership

- Why proven mass-production capability, safety certifications, and field data now outrank “innovative tech” slides

- How supply chain resilience, localization, and IRA/EU compliance quietly make or break supplier shortlists

- Where co-development speed, BMS integration, and sustainability metrics tip the decision between two similar bids

If you’re preparing an RFI/RFQ, pitching as a pack supplier, or pressure-testing your current partner, this is the inside scoring framework OEMs actually use — and where smart teams gain an edge before the contract is ever signed.

What OEMs Really Look For in EV Battery Pack Suppliers

When you choose an EV battery pack supplier, you’re not just buying hardware—you’re locking in cost, risk, and brand reputation for the next decade. As someone who’s sat on the OEM side of the table, I can tell you we evaluate an EV battery pack supplier with a very specific, very unforgiving lens.

Who Actually Decides at the OEM

You’re not selling to “the OEM.” You’re selling to a small group of people who all have a veto:

- Purchasing / Sourcing – Owns the EV battery pack sourcing strategy, price, commercial terms, and risk.

- Engineering (Vehicle + Energy Storage + E/E) – Owns pack architecture, integration, BMS interfaces, safety, and validation.

- Quality & Plant Launch – Own IATF mindset, APQP/PPAP, and whether your pack can run at rate without shutting down a line.

- Finance & Program Management – Own TCO, business case, cashflow, and launch timing.

- After-Sales / Service – Own warranty risk, field failures, and serviceability of your custom EV battery pack.

If any one of these groups loses confidence in a battery pack OEM, you’re out.

Why Supplier Choice Is Now Make-or-Break

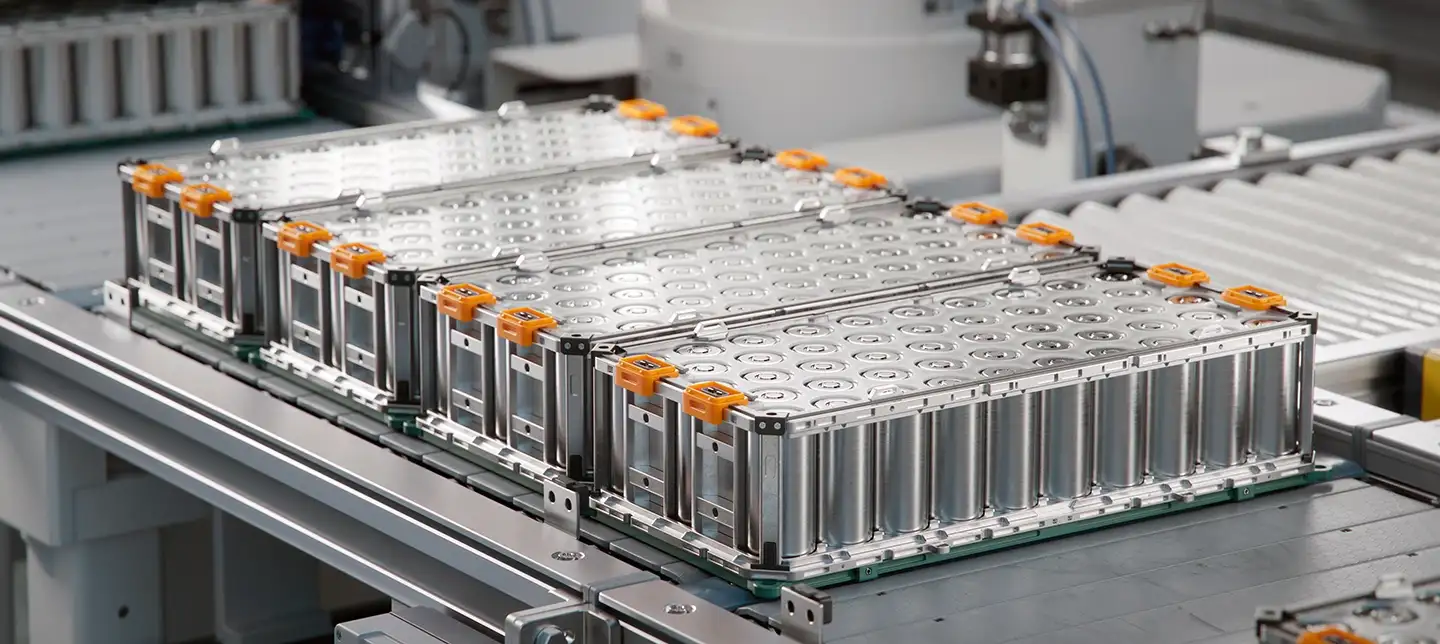

For modern EV programs, the EV battery pack can easily represent:

- 30–40% of vehicle BOM cost

- The #1 driver of range, safety, and warranty risk

- The biggest single cause of launch delays when suppliers overpromise on capacity or lead times

Pick the wrong EV battery pack manufacturer, and you get:

- Unstable battery pack cost per kWh

- Field issues that trigger recalls and brand damage

- Supply disruptions that idle plants and kill margins

That’s why OEMs treat automotive battery pack sourcing as a board-level decision, not just another RFQ.

How OEMs Really Evaluate EV Battery Pack Suppliers

Internally, we use a structured, scorecard-based framework to compare every EV battery pack supplier on the shortlist. It usually includes:

- Cost & TCO – Delivered cost per kWh, warranty reserves, recycling.

- Technology & Performance – Energy density, cycle life, 400V vs 800V fit.

- Capacity & Lead Time – Real GWh installed vs PowerPoint claims.

- Quality & Safety – Certifications, process capability, safety record.

- Supply Chain & Localization – US/EU compliance, China+1, IRA readiness.

- Sustainability & Financial Health – CO₂ per kWh, balance sheet strength.

- Partnership & Support – Co-development, on-site support, after-sales.

Every EV battery pack factory that wants to supply top OEMs has to clear all of these bars, not just one or two. When I evaluate a custom EV battery pack partner for the U.S. market, this is the exact filter I use—because anything less shows up later as plant downtime, recalls, or blown business cases.

Delivered Cost per kWh and Total Cost of Ownership

When OEMs evaluate an EV battery pack supplier, delivered cost per kWh is the first hard filter. In our own RFQs, we define it very simply:

- Cell costs (including yield loss and scrap)

- Pack manufacturing (housing, BMS, cooling, labor, overhead)

- Logistics (packing, inland freight, ocean/air, insurance)

- Duties, tariffs, and local taxes into the final assembly plant

We always normalize this to a $ / kWh at the OEM plant gate, which lets us compare any EV battery pack manufacturer on a clean, apples‑to‑apples basis.

But OEMs don’t stop at sticker price. They’re modeling EV battery total cost of ownership (TCO) over 8–15 years, and that’s where suppliers get separated fast:

- Warranty reserves: Expected failures over the warranty period, priced in from day one.

- Field failure rates: Historical ppm and real-world pack returns by climate, use case, and mileage.

- Service and replacement costs: Labor hours, pack accessibility, module vs full-pack replacement, dealer training.

- Recycling and end-of-life: Who pays, who owns the recovered materials, and how that ties into future pack sourcing.

For U.S. programs, we also care a lot about price stability. OEM purchasing teams will pressure every EV battery pack OEM to commit to:

- Price indexation linked to clear indices (lithium, nickel, copper, FX) with caps and floors.

- Hedging strategies so neither side gets wiped out by raw material spikes.

- Long-term price curves that align with volume ramps and learning-curve savings.

In RFQ models, we typically run multiple cost scenarios per supplier:

- Base case: quoted $/kWh with agreed indexation.

- High-commodity case: stress-test lithium/nickel prices and see who blows up.

- Degradation case: different cycle life and failure assumptions feeding into extra warranty and service cost.

That’s how serious OEMs in the U.S. now look at EV battery pack sourcing: not “Who’s cheapest today?” but “Who has the lowest risk-adjusted TCO per kWh over the life of the program?”

If you want a broader view of how leading players stack up on cost and technology, it’s worth comparing your shortlist against the major names in this global EV battery pack suppliers overview.

Technology Maturity and Energy Density Targets

When OEMs evaluate an EV battery pack supplier, technology maturity and energy density targets are non‑negotiable. If your EV battery pack can’t hit the right balance of readiness, range, and reliability, you’re not making the short list.

Minimum Technology Readiness OEMs Expect

For a new EV battery pack, most OEMs want:

- TRL 7–8 or higher: full pack proven in vehicle-level prototypes, not just cell lab results.

- A clear validation history: cell → module → pack testing, with correlation to real U.S. driving conditions.

- Documented DFMEA/PFMEA and design freeze milestones that show you’re ready for mass production, not still experimenting.

If you’re pitching cutting‑edge chemistries or structural packs, you’ll be asked to prove that the tech is stable enough for 8–10 years on the road, not just press‑release ready.

Energy Density Benchmarks by Segment

OEMs compare EV battery pack suppliers by gravimetric (Wh/kg) and volumetric (Wh/L) energy density at the pack level, not just the cell datasheet.

Typical targets today (pack level, U.S. market focus):

- Entry / value EVs (LFP-heavy)

- ~130–160 Wh/kg

- ~250–320 Wh/L

- Mainstream crossovers / SUVs (NMC, NCA)

- ~160–190 Wh/kg

- ~320–400 Wh/L

- Premium / performance EVs

- 190+ Wh/kg

- 400+ Wh/L

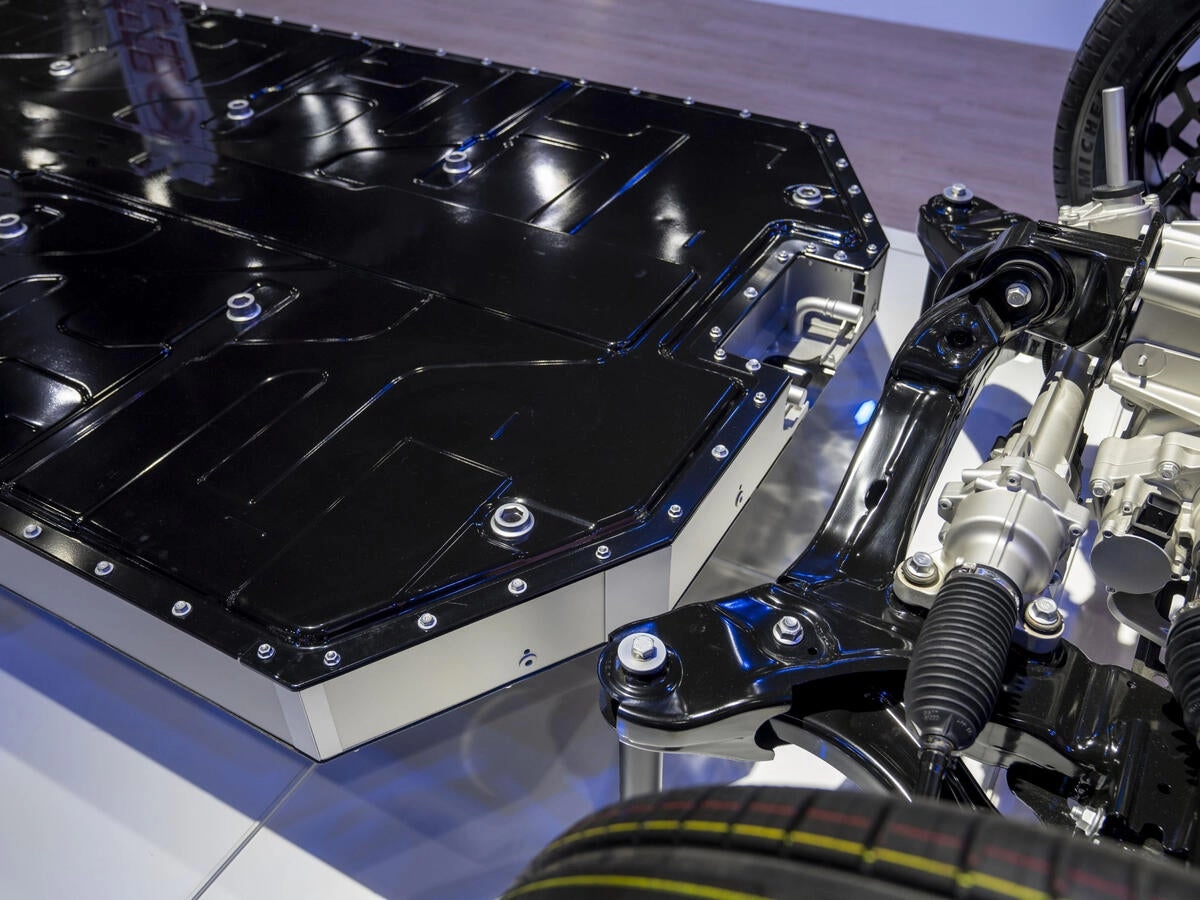

OEMs also expect you to show how you’ll improve density over the life of the program and whether you support newer formats like CTP (cell-to-pack) and structural pack designs that push density further. For example, we design around CTP and CTC battery technologies when OEMs want next‑gen range and cost structure.

Real-World Cycle Life Expectations

On paper cycle counts don’t impress anyone anymore. OEMs look for:

- 1,500–2,000+ full‑equivalent cycles at pack level under U.S. mixed highway/city profiles.

- 70–80% SOH (state of health) remaining at end of life under realistic DC fast‑charging usage.

- Proven calendar life at elevated temperatures (e.g., Southwest and Sunbelt climates).

You’ll be asked to show:

- Degradation curves by climate, charge rate, and drive profile

- How your pack design and thermal system reduce warranty risk over 8–10 years / 100k–150k+ miles

400V vs 800V Platform Compatibility

Most OEMs are planning multi‑platform strategies, so they lean toward EV battery pack suppliers who can handle both 400V and 800V architectures, or offer a roadmap to get there.

What they check:

- Support for 400V systems on today’s high‑volume platforms

- Clear compatibility or migration path to 800V for next‑gen fast‑charging and performance programs

- Voltage window, insulation design, and BMS capability aligned with higher system voltages

If your packs are tuned for only one voltage class, you’ll be seen as a niche solution. OEMs prefer partners who already understand how 400V vs 800V battery platforms change pack layout, cooling, wiring, and cost structure, similar to what’s covered in this breakdown of 400V vs 800V EV battery pack platforms.

Innovation vs Proven Technology Risk

OEMs walk a tightrope between betting on innovation and avoiding launch disasters. In practice, they tend to favor EV battery pack suppliers who:

- Use proven chemistries (LFP, NMC) but innovate in pack architecture, thermal design, and BMS controls

- Offer step-change improvements (e.g., CTP, structural packs, optimized cooling) with validated data and fleet trials

- Show redundancy plans if a new technology underperforms (fallback cell suppliers, alternate chemistries, derated fast‑charge strategies)

If you can demonstrate:

- Mature technology (TRL 7–9)

- Competitive energy density and cycle life

- A realistic roadmap for 400V and 800V platforms

you’ll stand out as an EV battery pack supplier that meets OEM battery supplier selection criteria without exposing them to unnecessary launch risk.

Proven Production Capacity and Lead Time Reliability

When OEMs evaluate an EV battery pack supplier, proven production capacity and real lead time reliability are non‑negotiable. If you can’t ship, nothing else matters.

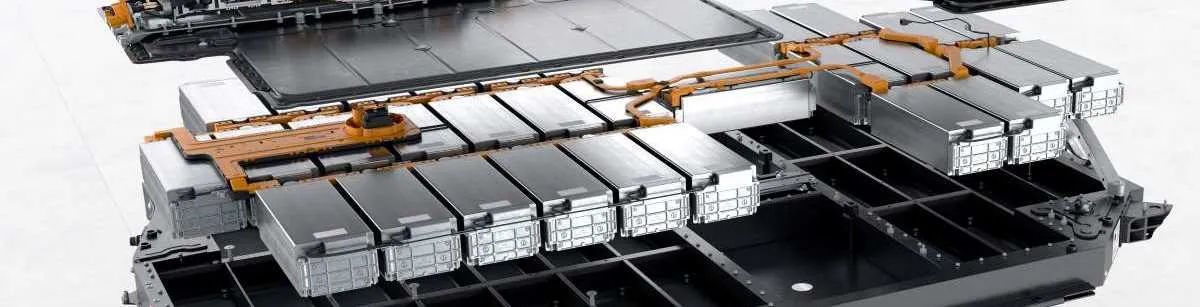

Installed GWh Capacity vs. Contracted Programs

OEMs don’t just ask “What’s your GWh capacity?” They ask:

- Current installed GWh vs. realistic annual output

- How much capacity is already locked by other customers

- How many lines are qualified for automotive, not just pilot runs

If a supplier claims 10 GWh but 8 GWh is already committed, you only have 2 GWh to play with. We always show a clear capacity map by plant, line, and customer so OEMs can see exactly what’s truly available.

On-Time Delivery Track Record

On-time delivery is worth more than a pretty PowerPoint. OEMs check:

- 3–5 year on‑time delivery rate for packs and modules

- Correlation between “nameplate” capacity and actual shipments

- Logistics performance into U.S. plants (port congestion, customs, inland freight)

We typically share historical OTD > 95% data, plus how we protected programs during disruptions, similar to the real-world lessons in this breakdown of EV battery pack manufacturing across China, USA, and Japan.

Ramp-Up Risk: 10k to 500k+ Packs

The biggest risk in EV battery pack sourcing is the ramp from pilot (10k/year) to mass production (500k+/year). OEMs want proof that:

- You’ve scaled a similar volume curve before

- You have tooling, automation, and staffing plans for each ramp phase

- You can handle launch volatility (schedule changes, mix changes, rework)

We usually present ramp scenarios with hard constraints: headcount, shifts, OEE targets, and buffer capacity, so the OEM sees how we avoid launch chaos.

Lead Time Expectations by Region

Lead time from PO to delivery is now a strategic lever, especially for U.S. OEMs. Typical expectations:

- North America / local pack plant: ~6–10 weeks PO‑to‑delivery

- Trans-Pacific (Asia to U.S.): 12–16+ weeks including ocean and customs

- Europe: similar windows, adjusted for regional regulations and trucking

We lock in frozen horizon + flexible horizon models so OEMs know exactly what’s firm vs. adjustable inside the planning window.

Capacity Reservations and Take-or-Pay Clauses

High‑volume OEM programs usually secure capacity reservations backed by:

- Take‑or‑pay clauses (OEM commits to a minimum volume or pays a fee)

- Tiered capacity fees vs. piece price structure

- Step‑up commitments tied to milestones (SOP, ramp year, facelift)

From our side, we use these tools to justify investments in new lines and local plants. From the OEM side, they get guaranteed slots and predictable lead times. The key is transparent modeling of cost, risk, and volume, not vague promises.

Quality Systems and Mass-Production Readiness for an EV Battery Pack Supplier

If an EV battery pack supplier isn’t locked in on quality and repeatability, nothing else matters. When I evaluate an EV battery pack manufacturer for large North American programs, I’m basically asking: “Can you build the same safe, high-performing pack a million times in a row?”

Core quality certifications OEMs expect

For serious automotive battery pack sourcing, the baseline is non‑negotiable:

- IATF 16949 – This is the ticket to play. Without it, most OEMs in the U.S. won’t even open your RFQ.

- VDA 6.3 – Especially important if you’re supplying to German or global OEMs; strong VDA audit scores build trust fast.

- ISO 9001 & ISO 14001 – Quality and environmental management are now table stakes for any EV battery pack OEM.

- Safety & process-specific certs – UL, IEC, and local safety norms support the story that your automotive battery pack factory is actually production-ready.

If an EV battery pack supplier can’t provide current certificates and audit reports on request, that’s a red flag.

APQP, PPAP, and change discipline

OEM battery supplier selection criteria in the U.S. are heavily process-driven. The EV battery pack supplier has to live and breathe automotive APQP/PPAP:

- APQP (Advanced Product Quality Planning)

- Structured DFMEA/PFMEA for cells, modules, and packs

- Clear control plans on all critical-to-safety and critical-to-function steps

- PPAP (Production Part Approval Process)

- Full PPAP package for the EV battery pack: dimensional, performance, safety, and software-related tests

- Run-at-rate proving the line can sustain volume, not just pilot builds

- Change management

- Formal ECN/ECR process

- No silent changes to cells, BMS, thermal components, or software

- OEM signoff required for anything that can impact safety, performance, or lifetime

This level of discipline is what keeps field failure rates and warranty risk under control for U.S. EV programs.

Process capability and defect targets

For automotive battery pack production, OEMs aren’t guessing; they look at hard quality metrics:

- Process capability on key parameters

- Target Cpk ≥ 1.67 on critical features (weld quality, insulation resistance, leak tests, torque, HV checks, etc.)

- Inline monitoring and statistical process control (SPC) at each major station

- Defect rate expectations

- PPM (defects per million) targets agreed per component and per pack

- Clear roadmap toward “zero-defect” on safety-critical operations (e.g., cell welding, HV insulation, BMS flashing)

- Robust containment and 8D problem-solving when anything escapes

A good EV battery pack OEM will show real data trends, not just pretty slideware.

What OEM plant audits actually look for

When an OEM or Tier‑1 comes into an automotive battery pack factory in the U.S., they’re checking whether the shop floor matches the PowerPoint:

- Line design and flow – Clear separation of high-voltage, clean areas, and mechanical assembly; no chaos, no ad‑hoc fixes.

- Traceability – Full serial-level traceability from cell to pack, including BMS software version, torque data, leak results, and end‑of‑line tests.

- Work instructions & training – Updated, visual work instructions at every station; operator training records and certifications on file.

- Error-proofing – Poka‑yoke on mis-builds, wrong components, polarity issues, and software flashing; automated checks on HV safety.

- End‑of‑line testing – Functional, insulation, leakage, HV stress tests, and burn-in where needed, all logged to the digital traceability system.

If you want to benchmark EV battery pack suppliers for the U.S. market, start with this: Can they pass a real OEM VDA 6.3/IATF-style audit on any day, unannounced? The ones who can are the ones that keep your launch timing, warranty exposure, and brand reputation intact.

Thermal Management and Pack Durability

When OEMs evaluate an EV battery pack supplier, thermal management and pack durability are non‑negotiable. If your pack can’t control heat, you’re not getting sourced—no matter how cheap your cost per kWh is.

Cooling and Heating Strategies That Actually Work

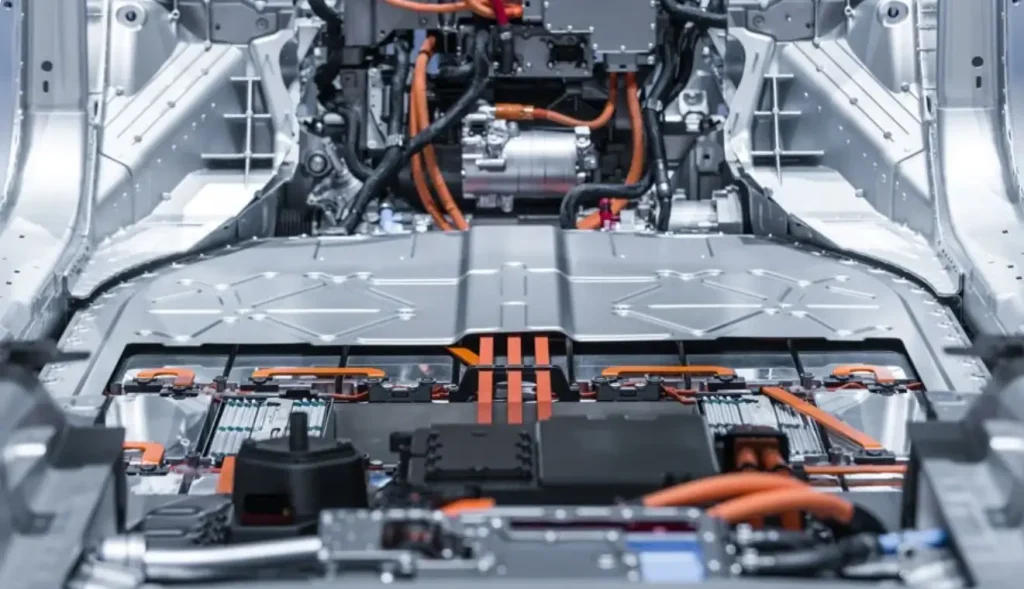

OEMs dig into how you handle both cooling and heating at cell and module level:

- Liquid cooling plates or channels between cells/modules (standard for mid‑ to high‑power U.S. EVs)

- Direct refrigerant cooling for high‑performance platforms that need aggressive heat removal

- Integrated heaters (PTC, heat pumps, or embedded elements) to keep packs in the sweet spot for fast charging in cold weather

- Smart BMS control of pumps, valves, and heaters so the pack doesn’t run hot in daily driving or fast charging

If your EV battery pack design relies only on passive cooling for U.S. use-cases (highway driving, towing, hot summers), most OEMs will mark that as high risk.

Hot and Cold Climate Performance Thresholds

OEMs in the U.S. test EV battery packs across brutal temperature ranges to simulate Florida heat, Arizona deserts, and Midwest winters. Common expectations:

- Reliable operation from −20°C to +55°C pack temperature

- Minimal fast‑charge throttling at high ambient temps

- Acceptable power and regen even after overnight parking at sub‑zero temps

- Limited performance loss over repeated hot‑soak + fast charge cycles

If your EV battery pack can’t hold performance in both hot and cold, your warranty model and TCO numbers will get hammered.

Vibration, Shock, and Corrosion Validation

Durability isn’t just about temperature. OEMs run aggressive tests to prove your automotive battery pack survives real U.S. duty cycles:

- Vibration and shock to simulate potholes, rough roads, and off‑road use

- Corrosion and salt spray for coastal and snow‑belt states (road salt is brutal)

- Water and dust ingress (IP ratings) to protect high‑voltage components

Tier‑1s that already supply into North America usually have strong data here. If you’re benchmarking suppliers, looking at established players in markets like Germany, the U.S., and China—such as those in this overview of top EV battery pack manufacturers in the US—is a good reference point for validation standards.

Thermal Design, Degradation, and Warranty Risk

Thermal design is directly tied to capacity fade, power fade, and calendar aging—all of which drive warranty cost:

- Poor cooling = hot spots = accelerated degradation on specific cells or modules

- Uneven temperature = imbalance = reduced usable SOC window and more BMS intervention

- Better thermal control = slower degradation, fewer field failures, and smaller warranty reserves

OEMs will compare your life test data at high temp against their internal cost models. If your pack loses too much capacity under hot‑cycle profiles, your EV battery pack total cost of ownership looks bad—even if your upfront pack price is attractive.

How Thermal Performance Feeds into TCO

Thermal performance is a major input in OEM TCO and RFQ models:

- Projected degradation curves → residual value and expected replacement rate

- Thermal system power draw → real‑world range and energy cost per mile

- Warranty claim projections for thermal‑related failures → added dollars per pack in OEM cost models

If you want to win EV battery pack sourcing decisions, you need clean, transparent data showing how your thermal management design reduces degradation, protects against thermal runaway, and lowers the OEM’s long‑term cost exposure—not just a nice spec sheet.

BMS Software, Controls, and Cybersecurity

When OEMs evaluate an EV battery pack supplier, the Battery Management System (BMS) software and controls can make or break the deal. Hardware can look similar on paper, but how the BMS monitors, protects, and talks to the vehicle is where real differentiation shows up.

Core BMS Functions OEMs Benchmark

Automotive OEMs will stress-test an EV battery pack OEM on a few non‑negotiable BMS functions:

- Cell and pack protection: fast, reliable over‑voltage, under‑voltage, over‑current, and short‑circuit protection. No nuisance trips, no slow reactions.

- Thermal control: closed‑loop control of heaters, pumps, fans, and valves to keep cells in the sweet spot across U.S. climates from Arizona heat to Minnesota winters.

- State estimation: robust SOC (state of charge) and SOH (state of health) algorithms that stay accurate over years, not just in lab conditions.

- Balancing: active or passive balancing strategies that protect energy density without killing cycle life.

- Diagnostics and fault handling: clear DTCs (diagnostic trouble codes), safe fallback modes, and detailed event logs OEMs can actually use.

If you’re positioning as a serious EV battery pack manufacturer or custom EV battery pack supplier in the U.S., these capabilities have to be proven, not just promised.

Data Quality, Diagnostics, SOH/SOC Accuracy

OEMs now treat the BMS as a data product:

- High‑resolution, time‑synced data (voltages, currents, temperatures) across the pack, modules, and cells.

- SOC accuracy within a few percent over the full life, including at low temperatures and high C‑rates.

- SOH tracking that predicts degradation and remaining useful life, not just a simple “percentage health” guess.

- Advanced diagnostics: cell imbalance trends, internal resistance tracking, and event‑based logging that supports fast root‑cause analysis and warranty defense.

Clean, well‑structured data is also a must-have for predictive maintenance, fleet analytics, and any long‑term battery pack total cost of ownership modeling.

Integration With Vehicle ECUs and Software Stacks

An EV battery pack supplier in the U.S. market has to integrate cleanly with legacy and next‑gen vehicle platforms:

- Standards‑based communication: typically CAN, CAN FD, sometimes Ethernet, using OEM‑specific or standardized messaging.

- Tight integration with VCU/PCU: torque limits, power derating, DC fast‑charging control, and thermal strategies must coordinate seamlessly with the vehicle control unit and powertrain.

- Software toolchain compatibility: support for OEM calibration tools, over‑the‑air flashing systems, and CI/CD processes.

- Clear APIs and documentation: OEM software teams expect stable interfaces and version control, not black boxes.

Stronger integration support often outweighs a slightly lower EV battery pack cost per kWh because it cuts launch risk and software rework.

Cybersecurity and OTA Requirements

Cybersecurity is now a line item in every serious EV battery pack supplier evaluation:

- Compliance with ISO/SAE 21434 and UNECE R155/R156 for cybersecurity and software update management.

- Secure boot, authenticated firmware, encrypted communications, and hardened diagnostics access.

- OTA update capability for BMS firmware with rollback options and rigorous validation flows.

- Clear handling of penetration test results, vulnerability disclosure, and patch rollout timelines.

OEMs want proof that a battery pack manufacturer can keep vehicles secure over 10+ years of software updates, not just at SOP.

Co‑Developing BMS Features With OEMs

For U.S. programs, especially high‑volume or flagship EVs, OEMs often prefer EV battery pack suppliers that are willing to co‑develop BMS features:

- Joint design of fast‑charge profiles, thermal strategies, and driving-mode‑specific power limits.

- Shared ownership or licensed use of key BMS algorithms and diagnostics.

- Co‑located engineering teams that can move from A‑sample to SOP with fast calibration loops and real‑time debugging.

Suppliers that show a genuine partnership mindset around BMS software, controls, and cybersecurity typically score higher than “build‑to‑print” vendors, even if their initial quote isn’t the absolute lowest.

Sustainability, Carbon Footprint, and Circularity in EV Battery Pack Supplier Evaluation

When I look at an EV battery pack supplier in the U.S. market, sustainability is no longer a “nice to have.” It directly affects sourcing decisions, especially for OEMs under IRA, EPA, and upcoming EU-style rules. If a battery pack manufacturer can’t prove their environmental performance with hard data, they’re off the shortlist fast.

Scope 1–3 Emissions at Pack Level

For any EV battery pack supplier I take seriously, I expect:

- Full Scope 1–3 emissions tracking at the pack level, not just cell production

- Clear breakdown of:

- Scope 1: direct factory emissions

- Scope 2: purchased electricity (with U.S. grid mix or renewable share)

- Scope 3: mined materials, refining, logistics, and end-of-life

- Data structured to support digital battery passport requirements and OEM ESG reporting

This is standard now in serious RFIs and RFQs for EV battery pack sourcing.

kg CO₂e/kWh Benchmarks in RFQs

OEMs in the U.S. are asking every EV battery pack manufacturer to quote:

- kg CO₂e per kWh at pack level, not just per cell

- Separate values for:

- Production in the U.S. vs. imported packs

- Different chemistries (NMC vs. LFP, etc.)

If you’re not in the low double-digit kg CO₂e/kWh range with a roadmap to reduce further, you’ll lose points in the RFQ cost–risk–sustainability scorecard.

Recycled Content and Regulatory Thresholds

We build our EV battery pack sourcing strategy assuming:

- OEMs will demand minimum recycled content for nickel, cobalt, lithium, and aluminum

- U.S. buyers will increasingly ask for:

- % recycled content by mass

- Certified sources (e.g., domestic recycling partners)

- Future IRA and state-level rules will push higher recycled content thresholds for local incentives

Suppliers that already hit meaningful recycled content targets get a clear edge.

Second-Life, Repurposing, and Recycling Partnerships

To reduce total cost of ownership and risk, I expect an EV battery pack OEM to show:

- A defined second-life or repurposing path (stationary storage, backup power, etc.)

- Signed partnerships with:

- Licensed recyclers in North America

- Second-life integrators who can take back used packs

- Clear take-back, disassembly, and closed-loop recycling processes

This doesn’t just help sustainability; it improves residual value and helps OEMs hit circular economy goals.

How Sustainability Scores Affect Supplier Ranking

In real battery supplier selection, sustainability is now a weighted line item, not a slide at the end:

- Carbon footprint (kg CO₂e/kWh), recycled content, and circularity plans feed directly into the EV battery supplier scorecard

- A strong sustainability profile can:

- Break ties when cost and technology are similar

- Justify a slightly higher EV battery pack cost per kWh if it unlocks incentives or reduces regulatory risk

- Weak or vague sustainability data is a red flag and can knock a battery pack manufacturer out during internal reviews

If I’m choosing between EV battery pack suppliers for U.S. programs, the one with credible emissions data, real recycling deals, and a circularity roadmap usually wins the long game.

Intellectual Property, Licensing, and Exclusivity in EV Battery Pack Supplier Evaluation

When I evaluate an EV battery pack supplier in the U.S. market, IP and licensing are deal breakers. If the intellectual property picture isn’t clean, the rest of the proposal doesn’t matter.

Ownership of Pack, Module, Thermal, and BMS IP

For any EV battery pack OEM or automotive battery pack factory I work with, I want to see clearly who owns what:

- Pack & module design IP – enclosure, module structure, busbars, harnessing

- Thermal management IP – cooling plates, manifolds, refrigerant/glycol layouts

- BMS software & algorithms – SOC/SOH models, safety logic, diagnostics

- Mechanical integration IP – skateboard, structural pack, and CTP interfaces

I push suppliers to spell this out in the contract so there’s no fight later over who controls design changes, cost-downs, or tech reuse on future programs.

Licensed Chemistries vs. In‑House Developments

Most U.S. OEM battery supplier selection criteria now separate cell chemistry IP from pack system IP:

- If the EV battery pack manufacturer uses licensed chemistries (LFP, NMC, high-manganese, etc.), I want proof of valid licenses and royalty structure.

- If they claim in-house chemistry or special formulations, I need test data, patents, and clear ownership to avoid copycat or infringement risk.

My rule: no vague “proprietary chemistry” talk without paperwork and independent validation.

Exclusivity Rights, Territories, and Platform Deals

On big North American programs, OEMs often want exclusivity to protect their advantage:

- Per-platform exclusivity – the pack design and BMS are only used on that OEM’s EV platform.

- Territory exclusivity – for example, supplier can’t sell the same pack to a direct competitor in the U.S./Canada market.

- Time-bound exclusivity – locked for X years or for the life of the program.

I balance this with the supplier’s need to scale. Overly tight exclusivity can make an EV battery pack wholesale price less competitive, so I structure exclusivity around actual volume commitments.

Freedom-to-Operate and Litigation Risk

In the U.S., freedom-to-operate (FTO) is mandatory. I expect every EV battery pack supplier to:

- Run formal FTO checks in key markets (U.S., EU, China)

- Disclose any ongoing IP disputes, license obligations, or prior settlements

- Indemnify the OEM against third‑party IP claims tied to their pack, module, thermal, or BMS designs

If a supplier is already in heavy litigation or won’t provide IP indemnity, that’s a major sourcing red flag.

Protecting OEMs in Co-Development

When I co-develop a custom EV battery pack or structural pack for U.S. customers, the contract must lock in:

- Joint IP rules – what’s OEM-owned, supplier-owned, and jointly owned

- Use rights – can the supplier reuse generic technology for other clients, and can the OEM reuse interfaces or software on other platforms

- Data ownership – BMS data, diagnostics, and fleet analytics access for the OEM

- Exit plan – if the relationship ends, can another EV battery pack manufacturer build the same pack under license

This is how I turn EV battery pack sourcing into a defensible long-term advantage, not a legal headache waiting to happen.

Partnership mindset in EV battery pack supplier relationships

When OEMs in the U.S. pick an EV battery pack supplier, they’re not just buying hardware—they’re betting on a long‑term partner. A vendor mindset doesn’t cut it.

Dedicated OEM account teams and clear escalation

A serious EV battery pack manufacturer will give each OEM:

- A dedicated account team (sales, program management, quality, engineering)

- 24/7 escalation paths for safety or field issues

- Direct access to decision-makers, not just a generic support email

If an EV battery pack OEM can’t show you this structure on day one, they’re not ready for real automotive business.

Field failure investigation and root cause

For EV battery pack sourcing, what matters is how fast and how deep a supplier responds when something fails:

- Standard 8D / root-cause analysis with clear timelines

- Fast retrieval and teardown of failed packs for forensic analysis

- Transparent sharing of data (BMS logs, abuse test history, process records)

- Corrective actions that are locked into the production line, not just PowerPoints

OEM battery supplier selection criteria heavily favor suppliers who can prove they’ve handled real field failures without drama.

Warranty handling, parts, and service network

For U.S. customers, downtime kills trust. OEMs look for EV battery pack suppliers that:

- Support multi‑year warranties backed by real financial strength

- Keep critical spare packs and modules available in regional hubs

- Integrate with the OEM’s dealer and service network for quick swaps

- Offer clear turnaround times for warranty claims and repairs

EV battery total cost of ownership is directly tied to how cleanly warranty and parts availability are handled.

Joint roadmap and co-investment

The best EV battery pack OEMs act like long‑term partners:

- Joint technology roadmaps for chemistry, energy density, 400V/800V, and structural packs

- Co‑investment in local EV battery pack production or pack assembly lines in the U.S.

- Early alignment on next platforms, not just the current RFQ

This is how OEMs de‑risk future platforms and secure IRA-compliant, localized EV battery pack supply.

How OEMs spot real partners vs vendors

OEMs separate EV battery pack suppliers into “vendor” and “partner” using signals like:

- Do they show up with cross‑functional leadership, or just sales?

- Do they own problems fast, or argue and stall on every claim?

- Are they willing to adapt their EV battery pack design to the OEM’s service strategy?

- Do they share data, roadmaps, and risk, or hide behind NDAs and vague slides?

If you want to be chosen in a tight EV battery pack supplier evaluation, you need a partnership mindset, rock‑solid after‑sales support, and the structure to back it up.

Red Flags That Eliminate EV Battery Pack Suppliers Fast

When I evaluate an EV battery pack supplier in the U.S. market, a few red flags kill the deal almost instantly. If you see any of these, you should treat them as deal-breakers.

Missing Safety and Quality Certifications

For any EV battery pack OEM or EV battery pack manufacturer, missing or outdated certifications is a hard no.

Immediate red flags:

- No valid IATF 16949 or automotive-grade quality system

- No pack-level UN38.3 or transport certification

- Expired or “in progress” safety testing with no timelines

- Incomplete documentation for IEC, SAE, or local U.S. requirements

If a supplier can’t prove they’re certified, you can’t trust their EV battery pack quality, safety, or reliability.

Unverifiable Performance and Abuse Data

If I can’t verify the numbers, I assume they’re not real.

Watch out for:

- Cycle-life claims without full test reports (conditions, temperature, DoD, C-rates)

- No transparent abuse test results (nail penetration, crush, thermal runaway, short circuit)

- Only “internal data” with no third-party lab or OEM validation

- Refusal to share real-world durability or field failure data

EV battery pack supplier evaluation lives and dies on data. If they hide it, walk away.

Single-Source Cells and Critical Materials

Overreliance on one source is a huge supply chain risk, especially in the U.S. with IRA and localization pressure.

Red flags include:

- Only one cell supplier qualified with no second source plan

- Heavy dependence on a single region (e.g., one country for all cathode or anode materials)

- No strategy for China+1, North America, or EU diversification

- No backup for critical components like BMS ICs, contactors, or cooling parts

For serious EV battery pack sourcing, you need resilience, not fragility.

Unrealistic Lead Times and Capacity Promises

If an EV battery pack manufacturer promises the world but can’t prove it, I assume they’re over-selling.

Watch for:

- Big GWh “capacity” on slides with no running lines or automotive references

- Lead times that don’t match tooling, validation, and ramp-up reality

- No evidence of shipping 10k → 100k → 500k+ packs per year for any customer

- No clear plan for U.S. or local-for-local pack manufacturing

If production capacity and lead time claims don’t line up with factory photos, staffing, and equipment lists, that’s a serious risk.

Unclear IP, Data, and Software Ownership

In modern EV battery pack production, IP and software are as critical as hardware.

Red flags:

- No clear agreement on who owns BMS software, calibration data, or algorithms

- Ambiguous rights for battery data, cloud analytics, or diagnostics

- Vague licensing on chemistry, module, or pack design IP

- Ongoing or likely litigation around battery patents in the U.S. or EU

If you can’t clearly define who owns what, you’re setting yourself up for legal, warranty, and integration headaches later.

When I source EV battery packs for the U.S. market, I treat these red flags as non-negotiable. A serious EV battery pack supplier, whether wholesale, custom, or full EV battery pack OEM partner, will have clean answers and solid proof in all of these areas.

Using This Criteria Framework to Benchmark Your EV Battery Pack Suppliers

When I evaluate an EV battery pack supplier for the U.S. market, I treat it like a structured sourcing project, not a “gut feel” call. A simple, consistent framework keeps everyone honest and lets me compare an incumbent EV battery pack manufacturer against a new challenger on real data.

Build a practical EV battery pack supplier scorecard

I start with a one-page scorecard that mirrors how OEMs and Tier-1s think. At minimum, I score each EV battery pack supplier across:

- Delivered cost per kWh & TCO (price, logistics, warranty risk)

- Technology & performance (energy density, cycle life, 400V/800V fit)

- Capacity & lead time (installed GWh, ramp-up risk, regional supply)

- Quality & safety (IATF 16949, UN38.3, field failure rates)

- Thermal & BMS capability (thermal management, BMS software, cybersecurity)

- Supply chain & localization (IRA-compliant content, China+1, local-for-local)

- Sustainability (kg CO₂e/kWh, recycling, second-life options)

- Financial health & IP (stability, IP ownership, freedom to operate)

- Support & partnership (engineering support, service, co-development)

Each category gets a weight (for example: cost 25%, tech 20%, quality/safety 20%, capacity/lead time 15%, supply chain/sustainability 10%, financial/IP 10%). I score suppliers 1–5 in each bucket, then calculate a total weighted score.

Data to request from every shortlisted EV battery pack supplier

To make the scorecard real, I always request the same dataset from every EV battery pack OEM or automotive battery pack factory:

- Cost & TCO

- Line-item EV battery pack cost per kWh (cells, pack, logistics, duties)

- Price indexation formulas, hedging policy, and long-term price roadmap

- Warranty terms, reserve assumptions, field failure rate data

- Technical & validation

- Detailed spec sheets (energy density, cycle life, 400V/800V compatibility)

- Full test reports (durability, abuse, thermal, vibration, corrosion)

- BMS software feature list, diagnostics capability, OTA roadmap

- Capacity & lead time

- Installed and planned GWh capacity by plant and region

- Historical on-time delivery performance and typical lead times

- Ramp-up plan from SOP to peak volume, including staffing and tooling

- Quality & safety

- Copies of IATF 16949, ISO 9001, UN38.3, IEC, SAE, GB/T certifications

- APQP/PPAP process overview and key quality metrics (PPM, Cpk)

- Safety incident history and corrective actions

- Supply chain & sustainability

- BOM sourcing map, raw material origin, cell suppliers

- IRA and EU regulation compliance statements

- kg CO₂e/kWh for the pack, recycled content %, recycling partners

- Financial & legal

- Latest audited financials, major customers, and exposure breakdown

- IP ownership matrix (pack, module, thermal, BMS) and licensing status

If a supplier can’t provide this level of transparency, I move them down the list quickly.

Compare incumbent vs challenger EV battery pack suppliers objectively

To avoid internal bias toward the incumbent EV battery pack supplier, I:

- Use the same scorecard and data request for everyone

- Normalize cost to a common pack configuration and annual volume

- Compare total cost of ownership, not just quoted price

- Look at risk-adjusted scores (for example, discount a great price if capacity looks shaky or financials are weak)

- Run a simple scenario table:

- Base case: current quotes and volumes

- Stress case: higher warranty claims / slower ramp

- Growth case: extra volume and price step-downs

This makes it clear where a challenger EV battery pack manufacturer really beats the incumbent on hard numbers vs where there’s just hype.

Align internal teams on weighted criteria before negotiations

Nothing derails a battery sourcing decision faster than misaligned stakeholders. Before I negotiate with any EV battery pack OEM, I:

- Get purchasing, engineering, quality, finance, and program teams to agree on:

- The weight of each scorecard category

- Must-haves (for example, IATF 16949, UN38.3, IRA-compliant content)

- Deal breakers (for example, lack of local service, no BMS access, unclear IP)

- Lock the weighting before reviewing supplier proposals

- Share a “rules of the game” one-pager internally so everyone evaluates on the same basis

This way, I’m not re-weighting criteria to justify a favorite supplier after the fact.

Turn evaluation findings into contract terms and safeguards

The whole point of this EV battery pack supplier evaluation is to drive a safer contract. I push key risks and expectations directly into the agreement:

- Capacity & lead time

- Capacity reservations with take-or-pay or “pay for capacity” terms

- Delivery performance KPIs with penalties and recovery plans

- Cost & TCO

- Transparent price indexation formulas and raw material pass-through rules

- Volume-based price step-downs and long-term price caps/floors

- Quality & safety

- Defined PPM targets, Cpk thresholds, and continuous improvement plans

- Clear warranty scope, investigation process, and cost-sharing rules

- Technology & IP

- Access to BMS data, diagnostics, and APIs

- IP ownership, licensing, and freedom-to-operate clauses

- Rules for joint development, exclusivity, and platform-specific rights

- Sustainability & localization

- Minimum local content, IRA compliance, and carbon footprint targets

- End-of-life recycling and second-life responsibilities

By tying the EV battery pack supplier scorecard directly to contract terms, I turn a one-time evaluation into long-term protection for the program and the business.