Executive The $181B Pack Prize and Who Wins It

The global EV battery pack market is set for impressive growth, expanding from $114.9 billion in 2025 to $181.4 billion by 2030. This represents a strong compound annual growth rate (CAGR) of 12.1%—a clear signal of rising electric vehicle adoption and pack technology innovation.

On the platform front, 400V systems currently dominate with a 78% volume share in 2025, but their hold will soften to 61% by 2030. Meanwhile, the 800V platforms, known for premium fast-charging and efficiency gains, are expected to jump from 22% to 39% share in the same period.

LEAPENERGY is making notable strides here. In 2024, they shipped 3.2 GWh of battery packs and project a sharp increase to 12 GWh in 2025, reinforcing their role as a key player in the shift toward high-voltage, high-performance battery solutions.

As you navigate this evolving landscape, understanding these shifts will help anticipate which technologies and players are poised to lead the EV revolution. Stay tuned for deeper insights on how 400V and 800V batteries are shaping the future of EV packs.

Macro Drivers Locking in 12% CAGR

The global EV battery pack market is set for solid growth, locked into a 12% compound annual growth rate (CAGR) through 2030. Several key factors are driving this momentum:

Strong Policy Support: Governments are pushing hard for cleaner transportation. The European Union aims for a 55% CO₂ emission cut by 2030, China targets 50% of new vehicle sales to be new energy vehicles (NEVs) by 2030, and the U.S. Inflation Reduction Act (IRA) offers up to $7,500 in stackable tax credits for EV buyers. These policies are accelerating demand for advanced EV battery packs.

Falling Costs: Battery pack costs continue to drop sharply, making EVs more affordable. The average pack cost per kilowatt-hour (kWh) is forecasted to decrease from $112 in 2025 to $78 by 2030. This cost curve improvement is crucial to wider EV adoption across all market segments.

Mineral Mix Shift: The mineral composition inside battery packs is also evolving. Lithium iron phosphate (LFP) batteries are gaining back share, expected to represent 48% of packs by 2030, thanks to their safety and cost advantages. Meanwhile, Nickel-Cobalt-Manganese (NCM) chemistries decline to 35%, reflecting a strategic hedge against raw material price swings and supply chain risks.

These drivers combined create a stable growth environment, setting a reliable foundation for the widespread rollout of both 400V and 800V platform battery packs in the U.S. and global markets.

400V vs 800V: A Side-by-Side Technical Scorecard

When comparing 400V and 800V EV battery platforms, several key factors stand out:

| Feature | 400V Platform | 800V Platform | Benefit of 800V |

|---|---|---|---|

| Charging Power | 190 kW (10–80% in 21 min) | 420 kW (10–80% in 11 min) | Nearly twice as fast charging |

| Copper Weight | Baseline | 12 kg less copper per vehicle | Lighter, cuts material cost |

| Regenerative Braking Efficiency | Baseline | +4% improvement | Better energy recapture |

| Peak Current | 820 A | 420 A | 38% less heat generated |

| Cost Difference | Baseline | +$1,180 today, drops to +$420 by 2028 | Premium cost shrinking over time |

What does this mean?

- Faster charging: 800V systems can roughly halve charging time, making long trips and quick stops easier.

- Better efficiency: Less copper and improved regen means lighter, more efficient packs.

- Thermal management: Lower peak current reduces heat, extending battery life and safety.

- Cost trend: The extra cost for 800V is coming down rapidly, making it a more attractive choice for premium and even mid-market EVs.

This technical edge is helping 800V platforms gain ground, especially in the U.S. market where quick charging and range are top priorities.

2025–2030 Platform Migration Roadmap

The shift from 400V to 800V platforms is well underway and set to accelerate through 2030. Here’s what to expect:

2025: The 400V platform still dominates the A and B segments, covering most compact and midsize EVs. Meanwhile, 800V systems are primarily found in larger C and D segment SUVs and pickups, where fast charging and higher power demand justify the premium.

2027: We’ll see the first mass-market compact EV using an 800V platform, like the VW ID.3 successor. This marks a big step toward broader adoption, as higher voltage platforms become mainstream beyond premium and large vehicles.

2030: Over half (about 55%) of EVs priced above $60,000 will run on 800V silicon-carbide inverters. This advanced tech boosts efficiency and charging speed, making 800V the go-to choice for premium and performance EVs.

This roadmap shows clear momentum toward 800V platforms, driven by better fast-charging infrastructure and improved thermal management. For U.S. customers, expect faster charging and longer ranges in the premium EV market as 800V tech becomes more common.

Pack Architecture Winners: Smarter, Lighter, Modular

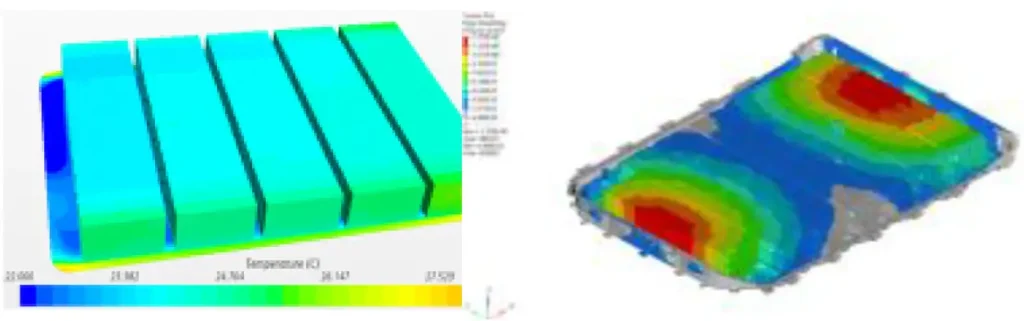

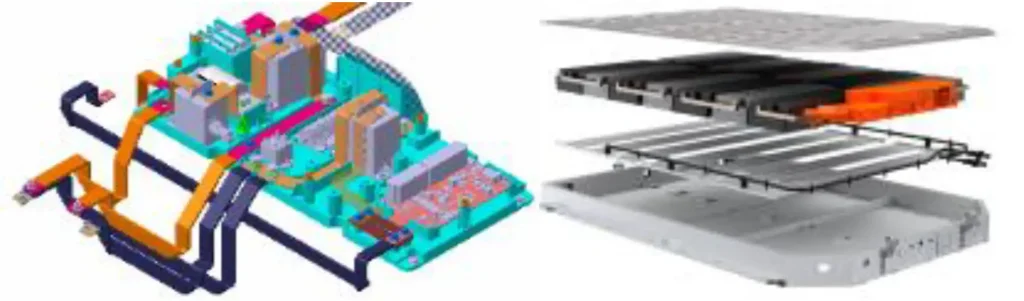

When it comes to EV battery pack design, LEAPENERGY is setting the pace with innovations that matter for U.S. drivers and manufacturers alike. Their Cell-to-Pack 2.0 technology, featuring 6-side cooling, boosts battery density by 18%. That means more power packed into the same space, helping EVs go further without adding bulk.

On the structural side, LEAPENERGY’s use of a die-cast floor combined with cell-to-chassis (CTC) integration cuts pack weight by 10% and trims costs by 7%. Lighter packs translate to better efficiency and range—key factors for American buyers looking for performance without compromise.

Modularity is crucial for production speed and flexibility. LEAPENERGY’s packs follow a modular swap-ready design, offered in three standardized heights—145 mm, 190 mm, and 230 mm. This simplifies assembly via robot lines and opens doors for future battery swapping standards in the U.S. market.

Key Takeaways:

- Cell-to-Pack 2.0: 18% higher energy density with advanced 6-side cooling

- Structural Pack Innovation: 10% lighter, 7% cheaper with die-cast floor + CTC

- Modular Design: 3 heights (145/190/230 mm) optimized for robotic assembly and swap readiness

These pack architecture advances aren’t just tech talk—they align perfectly with U.S. market demands for lighter, more efficient, and serviceable EV battery solutions.

Regional Heat Map

China dominates the global EV battery pack market with 62% of total GWh shipped, but it’s still mostly playing the cost game—only 14% of its packs use 800V platforms. The focus here is on affordable 400V systems, keeping upfront costs low as LFP cells rebound in popularity.

Europe is pushing ahead with 800V adoption, leading the pack at 41% penetration. The region is readying for ultra-fast charging, aiming for 1.8 MW charger deployments by 2028, which pairs well with advanced 800V silicon-carbide inverter platforms.

In North America, the story is all about trucks and larger EVs. The shift to 800V is driven by heavy hitters like the F-150 Lightning successor, focusing on higher power delivery and faster charge times tailored for pickup and SUV owners.

This regional split highlights where 400V remains king—cost-sensitive markets like China—and where 800V fast charging infrastructure is gaining ground, especially in Europe and North America’s truck markets.

Supply-Chain Bottlenecks & Solutions

The race to scale 800V platforms hits some key supply-chain snags—especially around silicon carbide (SiC) MOSFETs. By 2026, there’s a projected shortfall of 1.1 million units. The fix? Dual sourcing from Korea and Taiwan to keep production steady and avoid expensive delays.

On cooling, manufacturers are stepping up with advanced solutions. Micro-channel aluminum cooling plates and immersion cooling are on the roadmap to handle higher currents and heat better, which is crucial for keeping pack temperatures in check and extending battery life.

Meanwhile, regulatory pressures, especially from the EU, are forcing tougher recycling rules. With a 70% lithium recovery mandate, closed-loop contracts are becoming standard. That means battery makers and recycling firms work closely to reclaim valuable materials, helping reduce dependency on raw minerals and tightening the sustainability chain—something US OEMs will also need to watch as they scale up.

LEAPENERGY’s 800V-Ready Portfolio

LEAPENERGY’s 800V-Ready lineup stands out with its advanced CTP-800 module, designed for high performance and durability. It boasts a max voltage of 1,020 V and supports 620 A continuous current, delivering a solid energy density of 210 Wh/kg. This means more power and longer range, ideal for next-gen EVs aiming for efficiency.

They’ve streamlined the validation process with one-stop testing, achieving a 3,500-cycle calendar life and meeting strict UN38.3 battery safety standards—all within just 6 weeks. This ensures reliability and safety right out of the gate.

What sets LEAPENERGY apart is their fast co-development approach. They take concepts from the initial napkin sketch stage all the way to standard operating production (SOP) in just 14 months. This speed to market fits well with U.S. OEMs looking to launch competitive 800V platforms without delay.

Key highlights:

- CTP-800 module: 1,020 V max, 620 A continuous current, 210 Wh/kg energy density

- Rapid validation: 3,500 life cycles, UN38.3 compliance in 6 weeks

- Quick go-to-market: 14-month co-development from concept to production

For U.S. customers, LEAPENERGY’s 800V-ready packs bring reliable power with efficient pack-level safety and scalable cell-to-pack technology, making them a smart choice for the growing demand in fast-charging and high-performance EV markets.

5-Year Price & Penetration Forecast: 400V vs 800V Battery Packs

Here’s a quick breakdown of how the EV battery pack market shapes up from 2025 to 2030 in the U.S., focusing on price trends, market share, and fast-charging capabilities for 400V and 800V platforms.

| Year | Market Size ($B) | 400V Volume Share | 800V Volume Share | Avg. Pack Price ($/kWh) | Fast-Charge % of Market |

|---|---|---|---|---|---|

| 2025 | 114.9 | 78% | 22% | $112 | 30% |

| 2026 | 128.7 | 72% | 28% | $105 | 38% |

| 2027 | 142.9 | 65% | 35% | $95 | 45% |

| 2028 | 157.8 | 60% | 40% | $88 | 52% |

| 2029 | 169.8 | 58% | 42% | $82 | 58% |

| 2030 | 181.4 | 61% | 39% | $78 | 60% |

What’s Driving These Trends?

- Price Drops: Pack prices continue to slide, from $112/kWh in 2025 to around $78/kWh by 2030, making EVs more affordable overall.

- 800V Growth: The 800V platform grows steadily, capturing up to 39% of pack volume by 2030, mainly due to better fast-charging and efficiency benefits.

- Fast-Charge Demand: Fast-charging packs become the norm, increasing from 30% in 2025 to about 60% by 2030, meeting U.S. drivers’ growing expectations for quick top-ups on highways and urban routes.

- 400V Holding Ground: Despite the rise of 800V, 400V packs still dominate due to cost advantages, especially in more affordable segments popular in the U.S. market.

Why This Matters for U.S. Drivers

If you’re shopping for an EV in the next five years, expect better fast-charging options and more choice between pack types. The 800V battery packs are becoming common in trucks and premium SUVs—key segments in the U.S.—offering quicker charges and improved range. On the other hand, affordable EVs will mostly stick with 400V packs that keep costs down without sacrificing reliability.

This forecast shows the race is on between affordability and premium technology, but either way, EV drivers in the U.S. will see a significant boost in battery performance and charging speeds by 2030.