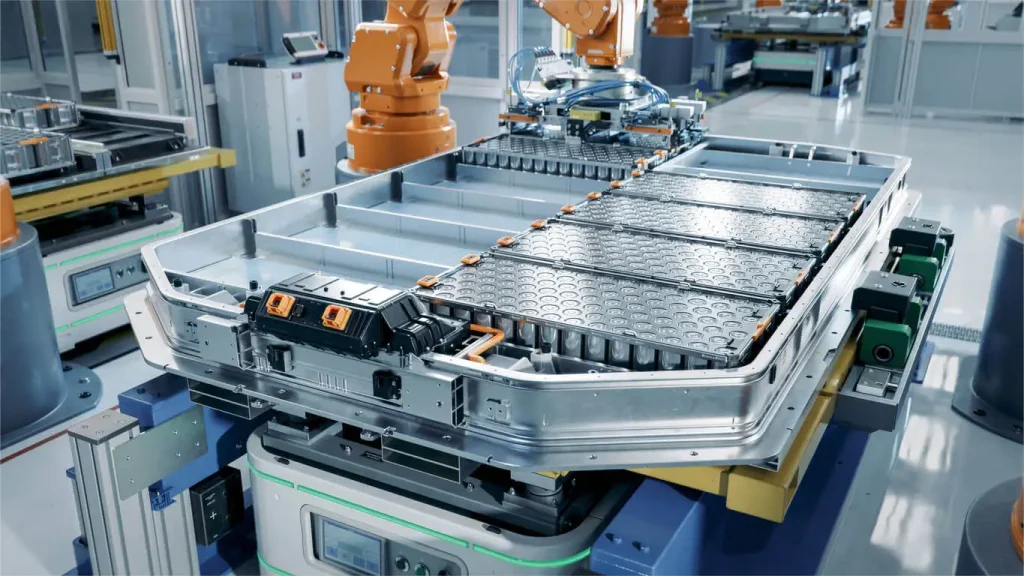

The electric vehicle (EV) revolution is reshaping the automotive landscape, with battery packs at its core. These energy storage units determine range, performance, charging speed, and overall vehicle efficiency. As global demand surges—projected to exceed 100 million EVs on roads by 2030—manufacturers in China, the United States, and Japan are vying for dominance. Each region brings unique strengths shaped by policy, innovation, and market dynamics. This blog explores the key players, advantages, challenges, and trends in EV battery pack production across these powerhouses, offering insights for industry stakeholders, investors, and consumers navigating this high-stakes sector.

The Rise of China in EV Battery Dominance

China has emerged as the undisputed leader in EV battery pack manufacturing, commanding over 56% of the global market share as of recent data. This dominance stems from aggressive government subsidies, a robust supply chain, and rapid scaling of production capacities. China focus on lithium-iron-phosphate (LFP) batteries, which are cost-effective and safer than traditional nickel-based alternatives, has given it a competitive edge in mass-market EVs.

Key manufacturers include Contemporary Amperex Technology Co. Limited (CATL), which holds approximately 38% of the global EV battery market. CATL supplies packs to major automakers like Tesla, BMW, and Volkswagen, with production exceeding 170 GWh annually. Its innovations in cell-to-pack (CTP) technology reduce weight and costs, enhancing vehicle efficiency. Another giant, BYD, integrates battery production with its own EV lineup, capturing about 16% market share. BYD’s Blade Battery design prioritizes safety and longevity, appealing to safety-conscious consumers.

Other notable players are CALB (China Aviation Lithium Battery) and EVE Energy, focusing on high-energy-density packs for premium and commercial vehicles. These companies benefit from vertical integration, controlling everything from raw materials like lithium to final assembly.

Advantages of Chinese manufacturers abound. Cost leadership is paramount; average battery pack prices in China hover around $127 per kWh, roughly 30% lower than in the US or Europe, thanks to economies of scale and access to abundant raw materials. Government policies, such as the “Made in China 2025” initiative, have poured billions into R&D, fostering breakthroughs in fast-charging and solid-state batteries. Additionally, China’s integrated ecosystem—from mining to recycling—minimizes supply chain disruptions.

- Market Share Breakdown: CATL (38%), BYD (16%), Others (e.g., CALB, Sunwoda) contributing to China’s 56% global hold.

- Key Innovations: LFP chemistry for affordability; sodium-ion batteries as a low-cost alternative to lithium.

- Production Targets: Many aim for 500-800 GWh by 2030, supporting China’s EV export boom.

In summary, China’s scale and cost advantages make it the go-to for affordable, high-volume battery packs, driving global EV adoption.

The US: Building Momentum Through Innovation and Policy

The United States, while lagging in market share at around 10-15% globally, is accelerating its EV battery sector through domestic investments and technological prowess. The Inflation Reduction Act (IRA) of 2022 has been a game-changer, offering tax credits and subsidies to onshore production, aiming to reduce dependence on Asian imports.

Tesla leads the charge with its Gigafactories, producing packs in Nevada and Texas. Partnering with Panasonic, Tesla’s 4680 cells promise higher energy density and lower costs. General Motors’ Ultium platform, developed in-house, offers modular designs for flexibility across its EV lineup, from the Chevy Bolt to Cadillac Lyriq. Ford, through joint ventures like BlueOval SK, is ramping up production of nickel-cobalt-manganese (NCM) and LFP packs.

Emerging players like Redwood Materials focus on recycling, creating a circular economy for batteries. This addresses sustainability while securing domestic lithium supplies.

US advantages include cutting-edge R&D from institutions like Argonne National Laboratory, leading to advancements in silicon-anode batteries for extended range. The IRA’s incentives have spurred over $100 billion in investments, creating jobs and fostering partnerships with Korean firms like LG Energy Solution for US-based plants. Consumer preferences lean toward high-performance packs with fast-charging capabilities, aligning with the US market’s emphasis on luxury and long-range EVs.

Image Source: https://us.misumi-ec.com/blog/ev-battery-cell-manufacturing-process/

Yet, hurdles remain. Higher production costs—often 20-30% above China’s—stem from labor and regulatory expenses. Supply chain vulnerabilities, with much lithium imported, expose the sector to global price fluctuations. Scaling up to meet ambitious targets, like 50% EV sales by 2030, requires overcoming talent shortages and infrastructure gaps.

- Market Share Insights: Tesla/Panasonic JV (~5-7% global), GM Ultium (~3%), with growth projected to 20% by 2030 via IRA boosts.

- Innovative Edges: Solid-state battery pilots; AI-optimized manufacturing for efficiency.

- Policy Impacts: Subsidies encourage localization, but tariffs on Chinese tech create short-term gaps.

Overall, the US is positioning itself as a hub for premium, innovative battery packs, emphasizing resilience and tech leadership.

Japan: Quality and Reliability in a Competitive Landscape

Japan, with about 10% global market share, excels in precision engineering and long-term R&D, though it trails China in volume. Japanese manufacturers prioritize quality, safety, and integration with hybrid systems, reflecting the country’s cautious shift from hybrids to full EVs.

Panasonic, a cornerstone, supplies Tesla with cylindrical cells from joint ventures in the US and Japan. Its focus on high-energy NCM batteries supports long-range applications. Toyota, through Primearth EV Energy, invests heavily in solid-state batteries, promising faster charging and higher densities—potentially revolutionizing the market by 2027. Other firms like GS Yuasa specialize in packs for industrial and marine EVs, emphasizing durability.

Advantages lie in technological maturity. Government support via the Green Growth Strategy targets carbon neutrality by 2050, funding R&D in next-gen tech like all-solid-state cells. Collaborations with US and European automakers enhance global reach.

Disadvantages include slower EV adoption domestically, limiting scale. High costs and conservative innovation pace have ceded ground to China’s aggressive expansion. Supply chain disruptions, like the 2022 chip shortage, highlight vulnerabilities in just-in-time manufacturing.

Image Source: https://www.voachinese.com/a/Toyota-Panasonic-battery-china-20201027/5638069.html

- Market Share Details: Panasonic (~8%), Toyota/Primearth (~2%), with niche players adding depth.

- Strengths in R&D: Solid-state prototypes; hybrid-to-EV transition tech.

- Future Outlook: Aims for 30% global share in advanced batteries by 2030.

Japan’s approach suits markets valuing longevity and precision, but it must accelerate to compete in volume-driven segments.

Comparative Analysis: Strengths, Gaps, and Future Trends

Comparing the three regions reveals stark contrasts. China excels in scale and affordability, ideal for mass-market EVs, but faces scrutiny on sustainability. The US shines in policy-driven innovation, targeting premium segments, yet struggles with costs. Japan offers unmatched quality, perfect for high-end applications, but lacks volume.

In terms of market share:

- China: 56% (dominated by CATL and BYD)

- USA: 10-15% (Tesla-led growth)

- Japan: 10% (Panasonic focus)

Advantages breakdown:

- Cost: China leads; US and Japan premium-priced.

- Innovation: US and Japan in advanced chemistries; China in practical scaling.

- Supply Chain: China integrated; US building domestic; Japan reliant on partnerships.

Disadvantages:

- China: Geopolitical risks.

- USA: High costs, import dependence.

- Japan: Slow scaling.

Looking ahead, trends like sodium-ion batteries (China-led) and solid-state (Japan/US) will shape the landscape. Global policies, such as EU tariffs and US subsidies, may fragment markets, but collaboration could accelerate sustainability goals. By 2035, battery demand could hit 3,500 GWh, with all regions expanding capacities.

Expand your knowledge with these post:

Top 10 EV Battery Pack Manufacturers in China

Top 10 Global EV/REEV Battery Pack Suppliers

Why Choose LEAPENERGY for Your EV Battery Needs

As the EV battery market evolves, partnering with a reliable supplier like LEAPENERGY ensures you stay ahead. Based in China with a global footprint, LEAPENERGY specializes in high-performance battery packs tailored for diverse applications, from passenger vehicles to commercial fleets. Our state-of-the-art facilities leverage cutting-edge LFP and NCM technologies, delivering packs with superior energy density, fast-charging capabilities, and extended lifecycles—up to 3,000 cycles at 80% capacity retention.

Dig deeper with our article:

Redefining Electric Mobility-Stellantis And Leapmotor Partner To Form Leapmotor International

What sets us apart? Competitive pricing without compromising quality, backed by rigorous testing and certifications like ISO 9001 and UN38.3. Whether you’re an automaker scaling production or a fleet operator seeking custom solutions, our modular designs integrate seamlessly, reducing time-to-market and costs. Visit https://leap.hiitio.com/ to explore our portfolio, request a quote, or schedule a consultation. Join the ranks of satisfied clients powering the future—contact us today and electrify your journey with LEAPENERGY’s innovative, sustainable battery solutions.